Over 30 years of anarchist writing from Ireland listed under hundreds of topics

Banks

Extending The Debt: The Great 'Promnight' Swindle

Sometimes you can walk around this city and feel like you are the last sane person left on the island.  On the front page of every single newspaper the spin doctors have gone into their highest setting possible with the great news that we’ve buried the rotten corpse of Anglo Irish bank which had been stinking up the whole economy for years now. We’d cut ourselves away from this horrible thing, we no longer had to pay out this awful promissory note for a staggering amount of €3.1 billion every year. We were now going to just liquidate the rottenest bank of all time, transfer it over to the men in black (NAMA) and the plan then was to pay interest only on this astronomical debt (€40 Billion) until 2038.

On the front page of every single newspaper the spin doctors have gone into their highest setting possible with the great news that we’ve buried the rotten corpse of Anglo Irish bank which had been stinking up the whole economy for years now. We’d cut ourselves away from this horrible thing, we no longer had to pay out this awful promissory note for a staggering amount of €3.1 billion every year. We were now going to just liquidate the rottenest bank of all time, transfer it over to the men in black (NAMA) and the plan then was to pay interest only on this astronomical debt (€40 Billion) until 2038.

Understanding the jargon behind the banking crisis - What are they talking About?

Financial ‘experts’ and economists seem to speak a different language to the rest of us. They rely on us not understanding what they’re on about. They know that if the gamble which constitutes the supposedly all-powerful ‘markets’ is revealed to us we will see just how crazy a system capitalism actually is.

Financial ‘experts’ and economists seem to speak a different language to the rest of us. They rely on us not understanding what they’re on about. They know that if the gamble which constitutes the supposedly all-powerful ‘markets’ is revealed to us we will see just how crazy a system capitalism actually is.

But the truth is revolutionary and it is important that we look behind their jargon. Here we explain just a few of the most commonly heard terms. [In Italian]

The historical development of the global financial order under US hegemony

In 'Financial Weapons of Mass Destruction', Paul Bowman examined the derivatives market and promised that the succeeding article would cover the 'story of the historical development of successive regimes of global financial orders' and would explain the role of the Eurodollars market 'in undermining the Keynesian Bretton Woods system'.

However, in the interests of space and relevance, I will only tell the story of the historical development of the regime of global financial order under US hegemony. I will begin by examining how the centre of capital accumulation shifted from Europe to the US in the first half of the twentieth century, and how following World War II the global financial order became centred around the US through the Bretton Woods system.

I will then look at how the Bretton Woods System was undermined, concentrating as much on the role of workers’ militancy as on the role of the Eurodollars market. After considering the response to the crisis of Bretton Woods, I'll look at the Clinton boom bringing us up to the current situation of the US’s current heavy dependence on foreign borrowing.

Financial Weapons of Mass Destruction

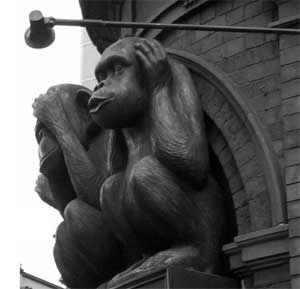

Written months before the banking crash of the Autumn of 2008 this is the first part of a series of articles investigating the capitalist financial markets from a critical perspective. It explains in some detail what the various financial instruments are that were to be blamed for the crash and what implication they have for class struggle. (Image: Just around the corner)

Written months before the banking crash of the Autumn of 2008 this is the first part of a series of articles investigating the capitalist financial markets from a critical perspective. It explains in some detail what the various financial instruments are that were to be blamed for the crash and what implication they have for class struggle. (Image: Just around the corner)

The cause of the crisis in global capitalism

A very detailed talk on the cause of the current world financial crisis that starts off by explaining the background economics in an easy to understand manner, moves on to the role the war and other events apart from the sub-prime crash played and concludes with a look at what opportunities have been created for anarchist by this sequence of events.

Right to Plunder the Economy, Not Right to Protest

This morning squads of Garda around Dublin mounted dawn raids on the houses of  water charges protesters over a sit in 3 months ago in Jobstown. At the same time across the city bankers and other speculators named in the HSBC Geneva Private Bank leaks slept soundly in their beds knowing no one was going to be knocking down their door. If you want to understand the nature of power the contrast provides an excellent example.

water charges protesters over a sit in 3 months ago in Jobstown. At the same time across the city bankers and other speculators named in the HSBC Geneva Private Bank leaks slept soundly in their beds knowing no one was going to be knocking down their door. If you want to understand the nature of power the contrast provides an excellent example.

The raids this morning were all about what the politicians' spin doctors like to call optics. Politicians, media and the Gardaí are on a drive to criminalise and marginalise those resisting the imposition of water charges. Sit ins and blockades have been part of political protest in Ireland for decades, the IFA routinely has far more militant protests.

![]()

Reclaim the City- Defend the ‘Peoples Bank’ in Belfast

Occupy Belfast will be holding a rally this Saturday outside the former Bank of Ireland building at 2pm. Following the rally there will be a public general assembly whereby all are invited to participate in the discussion on where next for the movement. There is a stall including leafleting outside the building every day at 1pm if anyone is interested in getting involved.

The liberation of a former Bank of Ireland building in Belfast

Occupy Belfast seized the initiative Monday by re-possessing the former Bank of Ireland building in Royal Avenue gaining media coverage both here and across the world. Around a dozen protestors including a WSM member entered the building, unfurled banners and put up barricades despite early attempts by the police to illegally evict us. A WSM member who took part gives us his views on the occupation below.

Occupy Belfast seized the initiative Monday by re-possessing the former Bank of Ireland building in Royal Avenue gaining media coverage both here and across the world. Around a dozen protestors including a WSM member entered the building, unfurled banners and put up barricades despite early attempts by the police to illegally evict us. A WSM member who took part gives us his views on the occupation below.

Resistance pays off in Greece as bond holders burnt

Months of intense resistance by ordinary people in Greece appear to have resulted in a partial victory. The EU crisis summit conceded that bond holders be forced to shoulder 50% of their losses. This did not come easy, Greek workers have staged several general strikes and Athens has seen day after day of large scale rioting.

Months of intense resistance by ordinary people in Greece appear to have resulted in a partial victory. The EU crisis summit conceded that bond holders be forced to shoulder 50% of their losses. This did not come easy, Greek workers have staged several general strikes and Athens has seen day after day of large scale rioting.

The contrast with Ireland is clear. Here the union leadership called off token resistance in the first months of the crisis and workers passively marched, shrugged their shoulders and went home. As a result the ordinary Irish worker alone, the majority of 'the 99%', have shouldered all the costs. Bond holders will scontinue to have their failed gambles covered. Next week alone another 700 million will be handed over to the Irish & global 1% to cover their losses in Anglo. This is our ‘thanks’ for being the poster boys for austerity across Europe.

The historical development of the global financial order under US hegemony

This article tells the story of the historical development of the regime of global financial order under US hegemony. It begins by examining how the centre of capital accumulation shifted from Europe to the US in the first half of the twentieth century, and how following World War II the global financial order became centred around the US through the Bretton Woods system. It then looks at how the Bretton Woods System was undermined, concentrating as much on the role of workers militancy as on the role of the Eurodollars market. After considering the response to the crisis of Bretton Woods, it concludes by looking at the Clinton boom, bringing us up to the current situation of the US’s current heavy dependence on foreign borrowing

This article tells the story of the historical development of the regime of global financial order under US hegemony. It begins by examining how the centre of capital accumulation shifted from Europe to the US in the first half of the twentieth century, and how following World War II the global financial order became centred around the US through the Bretton Woods system. It then looks at how the Bretton Woods System was undermined, concentrating as much on the role of workers militancy as on the role of the Eurodollars market. After considering the response to the crisis of Bretton Woods, it concludes by looking at the Clinton boom, bringing us up to the current situation of the US’s current heavy dependence on foreign borrowing