Over 30 years of anarchist writing from Ireland listed under hundreds of topics

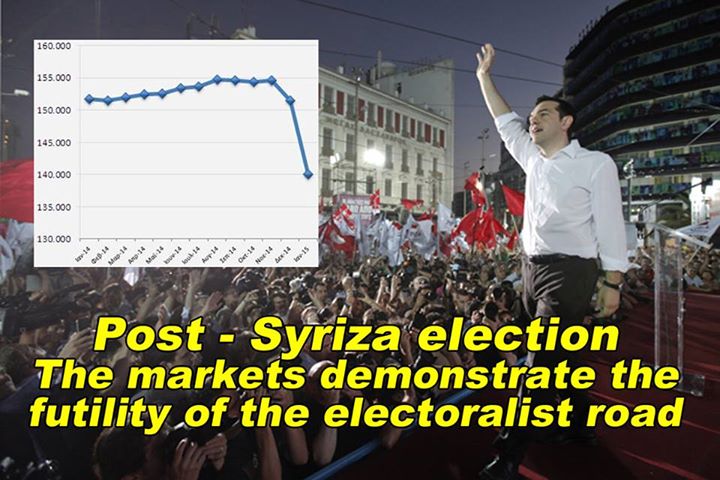

Post Syriza Election - Markets Demonstrate Futility of the Electoralist Road

The election of the radical left party Syriza in Greece has demonstrated how democracy and the capitalist market are enemies of each other. Far from accepting the democratic result of the election the response of the markets has been to try and make the mild anti-austerity measures on which Syriza was elected impossible.

The election of the radical left party Syriza in Greece has demonstrated how democracy and the capitalist market are enemies of each other. Far from accepting the democratic result of the election the response of the markets has been to try and make the mild anti-austerity measures on which Syriza was elected impossible.

Much of the focus has been on the formal visible process at the level of the EU negotiations and the arguments between the EU Finance ministers. A process that reduces the 503 million people living in the EU to spectators in a live performance of some West Wing style drama, one unfortunately uncritically engaged in by many on the left.

But that drama is only the surface manifestation of a very much deeper undemocratic process. That process is capital flight, the withdrawal of billions of euro from the Greek economy by a Greek and global capitalism that refuses to accept the results if the election. The world economy was restructured in the 1970-2010 period to make capital flight simple in the full knowledge this would make parliamentary democracy impossible, the Syriza election allows us to see that process in action.

The graph above shows one minor aspect of that capital flight, the sudden vanishing of Greek bank deposits.

Capital flight

When the left talks about capital it primarily means stocks, shares and bonds. Modern capitalism has developed so that technology on the one hand and the rules laid down by global institutions like the World Trade Organisation on the other, make the transfer of funds for the super rich (the top 0.01%) from country to country possible at a keystroke. When the government of Cyprus tried to pay for its banking crisis through seizing funds, the super rich largely managed to transfer its wealth out leaving the small saver carrying the costs.

It’s somewhat more complex for the rest of the 1% but even so its not that complicated or long a process to liquidate investments in one country and transfer them to another. The start of a financial crisis is often when that top 1% panics and starts to transfer its wealth out of a country.

Often that’s ahead of the fear of a banking collapse. Indeed the huge transfers of wealth generated by the fear of collapse can then ensure the collapse, the threat of that panicked the Irish government into the bank guarantee. But capital flight can also occur because of a concern that the election of a new government will be less favourable to the rich; It will certainly occur if - horror of horrors – a new government intends to attempt a wealth transfer from the rich to the rest of society. Capital flight removes the wealth that might have made such transfers possible as well of forcing a reversal of such policies. Established political parties know this – it’s an unstated limit on what policies can be passed that, because it’s unstated, it’s often invisible to the general public. But lets look at an earlier example.

1981 Mitterrand government

In 1981 for the 1st time in the 5th Republic a socialist, François Mitterrand because the president of France. He was elected on a radical left program with the Communist Party as coalition partners. This wasn’t hot air, policies and initial achievements included a 15% raise in the minimum wage, a minimum of 5 weeks holidays, a maximum 39 hour week and increased social welfare including a 64-81% increase in state pensions and a 44-81% increase in childrens’ allowance. This was to be paid for through a tax on wealth and to involve nationalisations of key industries. A lot of repressive legislation was also abolished, including the death penalty and limits were placed on police powers to stop and search.

The 1% responded by transferring wealth out of France, a process that in 1981 was much slower and more complex but which within two years brought Mitterand to heel. By March of 1983 Mitterand was forced to announce an ‘austerity turn’ and reverse some of what had been given. Despite this he was re-elected but during that second term the gap between rich and poor increased and unemployment and poverty rose as the economy went into recession. By the time he left power he was seen by many as yet another corrupt lying politician in a long line.

Back to Greece

By one estimate on Tuesday 17th February alone an estimated 900 million euros flowed out of Greek banks, this was the day after the talks broke up in Brussels. An idea of the scale of capital flight can be seen in the increase in Target Debt the Greek central bank now owes to other central banks in the Eurosystem. This increased 27 billion in January and another 15 billion in February.

Mario Draghi, President of the European Central Bank (ECB) and Jeroen Dijsselbloem, the Eurogroup chief far from being concerned at the massive attack on democracy capital flight represents have more or less welcomed it as forcing Syriza to be more 'reasonable' (i.e. to abandon the promises they were elected on and get down to a full implementation of 'austerity with a human face').

You will hear the same joy at the discipling of Syriza by the markets coming from the Irish Labour Party and RTE journalists. Some in Labour may once have been radicals but the 'Long march through the institutions' has done its job on them so that for us animals looking in the window we can no longer tell the difference between them and those they once claimed to oppose.

WORDS Andrew Flood, 19 March for WSM FB (Follow Andrew on Twitter )

The historical section of this article was also published in After the election of Syriza in Greece - Power is not in Parliament