Over 30 years of anarchist writing from Ireland listed under hundreds of topics

Household tax

Reports from the first anti-Household tax campaign meetings in Dublin, Cork & Galway

Reports from the first anti-Household tax meetings in Cork, Dublin & Galway.

What is needed to Build a National Campaign against the Household Tax

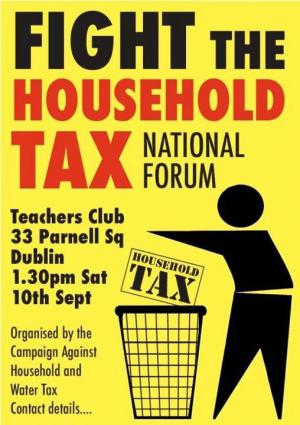

Workers Solidarity Movement member Gregor Kerr gave the leadoff at the session dealing with "Organising the Campaign" at the successful National Forum of the Campaign Against Household and Water Taxes on Saturday 10th September. What follows is the text of his contribution:

Workers Solidarity Movement member Gregor Kerr gave the leadoff at the session dealing with "Organising the Campaign" at the successful National Forum of the Campaign Against Household and Water Taxes on Saturday 10th September. What follows is the text of his contribution:

Successful National Forum sees Campaign against Household Tax gets organised

Last Saturday (10th September) over 200 people attended the National Organising Meeting of the Anti-Household & Water Tax Campaign. People from over 16 counties arrived during the first session in the afternoon with more arriving later. The meeting was organised to co-ordinate a mass non-payment campaign against the €100 household charge announced by the government to come into effect on 1st January 2012. The campaign sees this as the “first step in the government’s plans to implement a fully fledged property and water tax by 2014 that could be around €1,200 according to one government economic advisor. “ In the long-term, this paves the way for the privatisation of the water supply, as occurred with refuse collection.

Last Saturday (10th September) over 200 people attended the National Organising Meeting of the Anti-Household & Water Tax Campaign. People from over 16 counties arrived during the first session in the afternoon with more arriving later. The meeting was organised to co-ordinate a mass non-payment campaign against the €100 household charge announced by the government to come into effect on 1st January 2012. The campaign sees this as the “first step in the government’s plans to implement a fully fledged property and water tax by 2014 that could be around €1,200 according to one government economic advisor. “ In the long-term, this paves the way for the privatisation of the water supply, as occurred with refuse collection.

Organising against the household tax - You have a role to play

Workers Solidarity Movement members are currently centrally involved in helping to establish a campaign against the new household tax announced by the government. For this campaign to be successful it will have to be built at a local level in every area of Dublin and in every town and city around the country. The central plank of the campaign will be non-payment and it will be based on the successful anti-water charges campaign of the 1990s.

Workers Solidarity Movement members are currently centrally involved in helping to establish a campaign against the new household tax announced by the government. For this campaign to be successful it will have to be built at a local level in every area of Dublin and in every town and city around the country. The central plank of the campaign will be non-payment and it will be based on the successful anti-water charges campaign of the 1990s.

Mass Opposition to Proposed Household Charge - Boycott Campaign under way - But Sinn Fein Refuse to Support Non-Payment

The announcement from the government that households are to face a charge of €100 per annum from January 1st with separate water and property taxes to follow by 2014 has met with fierce opposition across the country. Radio and television shows have been inundated with texts and phonecalls from irate people who see this latest tax as a step too far and who have been pledging to resist the charge. In a TV3 IrelandAM poll this morning, Wednesday, 87% of people answered ‘Yes’ to the question “Would you consider boycotting the household charge?”

The announcement from the government that households are to face a charge of €100 per annum from January 1st with separate water and property taxes to follow by 2014 has met with fierce opposition across the country. Radio and television shows have been inundated with texts and phonecalls from irate people who see this latest tax as a step too far and who have been pledging to resist the charge. In a TV3 IrelandAM poll this morning, Wednesday, 87% of people answered ‘Yes’ to the question “Would you consider boycotting the household charge?”

Household & Water Tax Can’t Pay, Won’t Pay

The government has made it clear that it is determined to press ahead with its attempts to impose not one but two new taxes on us. Minister for the Environment Phil Hogan is preparing to bring plans to government for a household tax, probably starting at €100 per year, from 1st January. This tax will be added to by a water tax, expected to be introduced within the next couple of years.

The government has made it clear that it is determined to press ahead with its attempts to impose not one but two new taxes on us. Minister for the Environment Phil Hogan is preparing to bring plans to government for a household tax, probably starting at €100 per year, from 1st January. This tax will be added to by a water tax, expected to be introduced within the next couple of years.

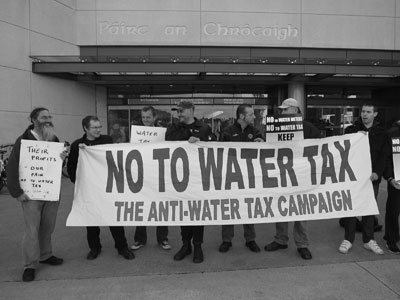

Anti-water tax campaigners protest metering conference at Croke Park

Around 60 anti-water tax campaigners placed a picket on the water metering conference at Croke Park this morning. Such a large turnout at 8.30 am must have caused concern for the attending companies who view the government plan to charge for and meter water as an easy way for them to make a fast buck. It has been announced that 600 million euro is to be spent imposing the plan. It's fast becoming clear that the introduction of water charges will face serious resistance and those attending must be aware that the previous attempt to impose a water tax was defeated by such mass resistance in the 1990's.

Around 60 anti-water tax campaigners placed a picket on the water metering conference at Croke Park this morning. Such a large turnout at 8.30 am must have caused concern for the attending companies who view the government plan to charge for and meter water as an easy way for them to make a fast buck. It has been announced that 600 million euro is to be spent imposing the plan. It's fast becoming clear that the introduction of water charges will face serious resistance and those attending must be aware that the previous attempt to impose a water tax was defeated by such mass resistance in the 1990's.

Greens & FF seek to impose water tax again

The Greens and Fianna Fáil have agreed a deal whereby a €225 flat tax will be levied on every household, regardless of income. The levy is expected to generate nearly €300 million a year in revenue. For families which are just barely scraping by, a levy of €225 a year is a serious attack.

Mutual Aid, solidarity & the household taxes

Mutual Aid is the fuel an anarchist society will run on. It is also what keeps capitalist society going in spite of all the hardship, greed, and exploitation that exists. Like all good ideas it's simple to understand. In order to get by in a tough world, it's necessary to get a bit of help from others. And as well as receiving help you also give it, not simply because it's nice to be nice, but because you know that sometime in the future you'll need a bit of it yourself.

Household & Service Tax cons - Taking from workers to give to the rich

The service charges that are being brought in north and south of the border are part of a process of further increasing the proportion of tax paid by workers. The trend in global capitalism is to replace 'progressive' taxes (like income tax) with flat-rate taxes (like VAT, service charges, etc) to further shift the taxation burden from rich to poor. This is the policy advocated by the world bank, IMF, WTO and virtually all of the institutions of global capitalism.